Income Limits 2025 Roth Ira. To max out your roth ira contribution in 2025, your income must be: Your personal roth ira contribution.

Roth IRA vs 401(k) A Side by Side Comparison, Limits on roth ira contributions based on modified agi. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

Fica Salary Limit 2025 Amye Kellen, And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older. You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re age 50 or older.

Limit Roth Ira 2025 Sadye Conchita, To max out your roth ira contribution in 2025, your income must be: To contribute to a roth ira, single tax.

Roth IRA Limits for 2025 Personal Finance Club, Limits on roth ira contributions based on modified agi. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Roth 2025 Limits Olly Rhianna, The same combined contribution limit applies to all of your roth and traditional iras. Your personal roth ira contribution.

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, Married filing jointly (or qualifying widow(er)) less than. Limits on roth ira contributions based on modified agi.

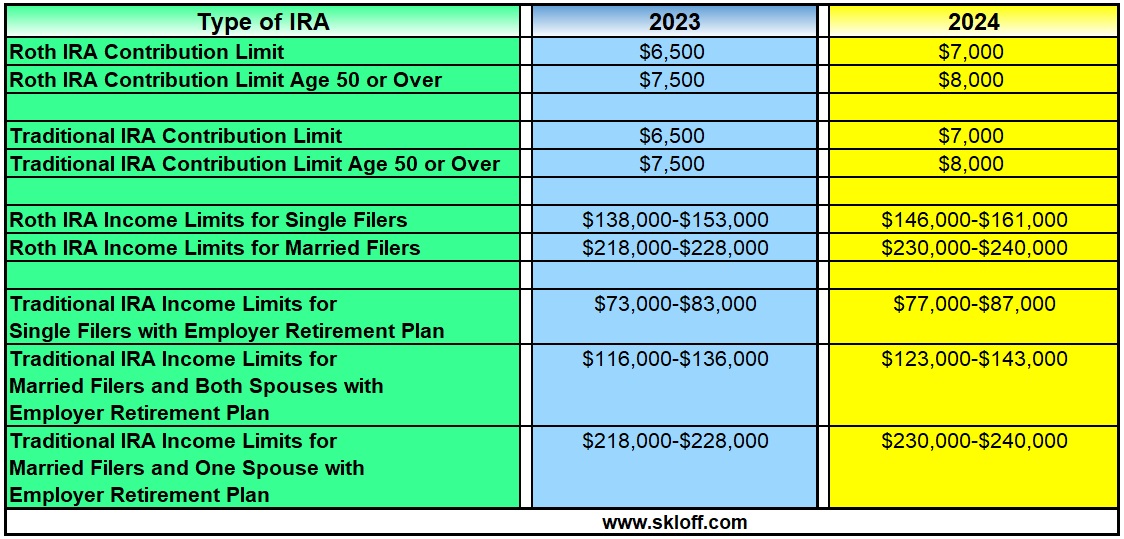

IRA Contribution and Limits for 2025 and 2025 Skloff Financial, The ira contribution limits have increased from $6,000 in 2025, $6,500 in 2025, and to $7,000 in 2025. For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025).

Roth Contribution Limits 2025 Caril Cortney, And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older. Find out if you are eligible to contribute to a roth ira based on your modified adjusted gross income, or magi.

401k And Roth Ira Contribution Limits 2025 Cammy Caressa, The roth ira contribution limit for 2025 is $6,500 for those under 50, and $7,500 for those 50 and older. 12 rows if you file taxes as a single person, your modified adjusted gross income.

Roth IRA Contribution Limits 2025 & Withdrawal Rules, You can contribute up to $7,000 to an ira in 2025, up from $6,500 in 2025. Less than $146,000 if you are a single filer.